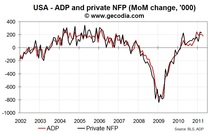

In April 2011, the employment growth in the private sector (ADP report) was disappointing. Job creations reached +179k after 207k in March. This is significantly under the consensus expectations (+200k) and the weakest recorded since last November. Payrolls in services rise by +138k and by +41k in the industry.

Economic Impacts

The ADP report for April 2011 implies (at best) a stable growth for total NFP. Currently, the consensus expects a NFP growth close to +200k in April after +230k in March. This level is strong enough to bring down the unemployment rate in the US and to provide a significant support to income growth.

Market Impacts

Forex: After the publication, the USD depreciates (EUR/USD moving up by 50 pips above 1,149; GBP/USD began to rise before the publication and remain stable after it; USD/JPY is down by 10 pips to 81.0 yen for dollar.

Commodities: For gold and WTI oil, prices were already moving upward before the publication and accelerate further just after it. Gold return just above 1540 $/oz and the WTI was back to 110.8 $/b.

Economic Impacts

The ADP report for April 2011 implies (at best) a stable growth for total NFP. Currently, the consensus expects a NFP growth close to +200k in April after +230k in March. This level is strong enough to bring down the unemployment rate in the US and to provide a significant support to income growth.

Market Impacts

Forex: After the publication, the USD depreciates (EUR/USD moving up by 50 pips above 1,149; GBP/USD began to rise before the publication and remain stable after it; USD/JPY is down by 10 pips to 81.0 yen for dollar.

Commodities: For gold and WTI oil, prices were already moving upward before the publication and accelerate further just after it. Gold return just above 1540 $/oz and the WTI was back to 110.8 $/b.

World GDP

World GDP