After Greece, Ireland and Portugal, the spread widened considerably for the Italian government bonds. The 10 years sovereign yield for Italy is now trading at 300bp (100bp = 1%) above the German Bund. The 5Y CDS for the public debt is now in the pain zone, at 293bp yesterday (+114bp over a week).

Until now Italy was a large and liquid market, the largest sovereign bond issuer in the euro area. But, the already massive public debt (120% of GDP), the odds of a prolonged sluggish growth, the political mess and growing fears about peripheral debt in the euro area have begun to contaminate investors.

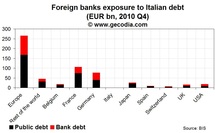

European banks (including UK banks) holds EUR 167 bn of Italian bonds (mainly in France – 74 bn – and Germany – 39 bn). Italian banks and insurers holds 245 bn of public debt. Is we take all into account (insurers, asset managers…), the foreign exposures to the Italian public debt is close to 806 bn.

Economic Impacts

With Italy under fire, the crisis is moving from a relatively small and manageable problem to a potential financial disaster. If the value of the bonds continues to fall (spreads to widen), the losses for banks could soon become huge. The first one to suffer will be Italians. In this case, you have to take into account claims over local banks. Consequently, the foreign exposure climbs to more than EUR 250 bn, with an heavy weight for the French (close to 100 bn) and German banks (75 bn).

Until now Italy was a large and liquid market, the largest sovereign bond issuer in the euro area. But, the already massive public debt (120% of GDP), the odds of a prolonged sluggish growth, the political mess and growing fears about peripheral debt in the euro area have begun to contaminate investors.

European banks (including UK banks) holds EUR 167 bn of Italian bonds (mainly in France – 74 bn – and Germany – 39 bn). Italian banks and insurers holds 245 bn of public debt. Is we take all into account (insurers, asset managers…), the foreign exposures to the Italian public debt is close to 806 bn.

Economic Impacts

With Italy under fire, the crisis is moving from a relatively small and manageable problem to a potential financial disaster. If the value of the bonds continues to fall (spreads to widen), the losses for banks could soon become huge. The first one to suffer will be Italians. In this case, you have to take into account claims over local banks. Consequently, the foreign exposure climbs to more than EUR 250 bn, with an heavy weight for the French (close to 100 bn) and German banks (75 bn).

World GDP

World GDP