The contagion already hits hard Spain and Italy, with 10 years sovereign yield spread with the German Bund now close or above 300bp (100bp = 1%) and 5Y CDS rising fast. But, France also experience the first symptoms of the debt disease. The French spread for the 10Y yield is now moving up and is close to 70bp, a record high since the beginning of century. The CDS is also up, and breaks yesterday, for the first time since the beginning of the Euro Debt Crisis, the 100bp ceiling.

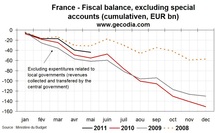

The chart above shows that the French State fiscal balance is still deep in negative territory. The austerity in France is a sweet one. The reduction in the deficit is coming mainly from revenues growth (up by 6% YoY in May 2011) and the end of special measures (total expenditures down by 3% YoY). But, the financing needs for the coming years will be huge.

Economic Impacts

With Italy under fire, this crisis has proven that no big country is safe. France has a relatively sound fiscal situation and if the future government respects the targets for the public deficit in the coming years, the debt/GDP ratio should stabilize under 100%.

However, the political situation in France, with major elections next year (President and Parliament), could lead to some complacency regarding the public deficit. The public debt is rising fast (83% of GDP in 2010; 91% in 2012 – OECD forecast). Moreover, a robust revenue growth is crucial in the current plan for fiscal sustainability. Who wants to bet on a strong growth in France for the coming years?

The chart above shows that the French State fiscal balance is still deep in negative territory. The austerity in France is a sweet one. The reduction in the deficit is coming mainly from revenues growth (up by 6% YoY in May 2011) and the end of special measures (total expenditures down by 3% YoY). But, the financing needs for the coming years will be huge.

Economic Impacts

With Italy under fire, this crisis has proven that no big country is safe. France has a relatively sound fiscal situation and if the future government respects the targets for the public deficit in the coming years, the debt/GDP ratio should stabilize under 100%.

However, the political situation in France, with major elections next year (President and Parliament), could lead to some complacency regarding the public deficit. The public debt is rising fast (83% of GDP in 2010; 91% in 2012 – OECD forecast). Moreover, a robust revenue growth is crucial in the current plan for fiscal sustainability. Who wants to bet on a strong growth in France for the coming years?

World GDP

World GDP