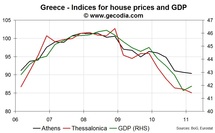

In 2011 Q1, the average price for housing in Greece dropped again in Athens (-0.3% QoQ) and Thessalonica (-1.2% QoQ), the most populated areas in the country. Indices for house prices are down since mid-2008 and are now reaching new lows (no data before 2006). Real estate prices are down by 11% from their peak in Athens and 17% in Thessalonica.

With yield close to 17% for 10Y government bonds and 26% for 2Y government bonds (high probability of default priced in by the bond market), it is pretty logical to see a downward trend for the real estate market. The fall in prices is following closely the decline in the GDP (-9% from mid-2008 to 2011 Q1).

Economic Impacts

The almost certain default of the Greek State (no matter which form) will deeply impact the Greek banks. But, there is also a risk coming from private debt. With a rising unemployment rate and a fall in housing price, doubtful loans could soon add some pressures on local banks core capital.

For the euro area financial system, the Greek public problem is relatively small (EUR 50 bn according to BIS data). But with the private debt, the total amount climbs to EUR 155 bn (70 bn for French banks and 53 bn for German banks).

With yield close to 17% for 10Y government bonds and 26% for 2Y government bonds (high probability of default priced in by the bond market), it is pretty logical to see a downward trend for the real estate market. The fall in prices is following closely the decline in the GDP (-9% from mid-2008 to 2011 Q1).

Economic Impacts

The almost certain default of the Greek State (no matter which form) will deeply impact the Greek banks. But, there is also a risk coming from private debt. With a rising unemployment rate and a fall in housing price, doubtful loans could soon add some pressures on local banks core capital.

For the euro area financial system, the Greek public problem is relatively small (EUR 50 bn according to BIS data). But with the private debt, the total amount climbs to EUR 155 bn (70 bn for French banks and 53 bn for German banks).

World GDP

World GDP